Welcome To The Data Leak Lawyers Blog

We focus on the latest news surrounding data breaches, leaks and hacks plus daily internet security articles.

We focus on the latest news surrounding data breaches, leaks and hacks plus daily internet security articles.

Given the continually large volumes of incidents that are happening, it’s important to approach the subject of data breaches and encryption.

In some cases, leaks can happen due to human errors or system problems. Some hacks may take place because 100% effective defence is a hard thing to achieve. This doesn’t excuse an organisation when it comes to their responsibilities, but it’s important for them to understand that it’s about more than just trying to stop incidents; it’s also about preventing damage.

And that’s where encryption and even basic levels of protection is king.

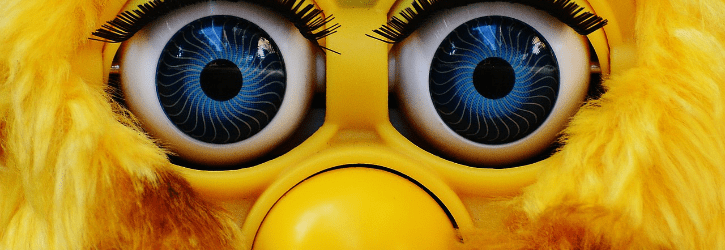

Serious concerns have been raised over security issues that could lead to smart toy data breaches and children being at risk of contact from strangers or exposure to explicit content.

Consumer group Which? has reportedly identified serious security flaws in a number of smart toys that could lead them to being hacked or interfered with. They’re now calling on big name retailers like Amazon, Argos, John Lewis and Smyths to withdraw some “intelligent” and “connected” toys for sale this Christmas. They’re also calling on the government to introduce mandatory security standards for smart toy manufacturers.

We’ve talked in the past about the dangers of smart toys and the “Internet of Things” as greater connectivity opens more doorways for cybercriminals. In the run up to the festive season, the consumer group’s findings are set to cause justifiable concern.

The Sweaty Betty data breach incident appears to be another case of cybercriminals using malicious code in checkout systems to steal sensitive information.

We’ve literally seen this before. Two of the big recent examples are British Airways and Ticketmaster; both of which are thought to be attacks carried out by the same group of hackers. Inserting code into checkout systems can lead to personal details and payment card data being exposed and that’s exactly what has happened in the Sweaty Betty case.

Anyone who has been affected in England and Wales may be entitled to bring a claim for data breach compensation, and we can help.

No one is above the law, and that includes our police service. If a police data leak ever takes place, victims are entitled to justice in the same way as anyone else can be.

Given that the police handle a monumental wealth of personal and sensitive information, their duties to comply with important data protection legislation is important. Any leak, breach or hack could lead to information exposure which could have a serious impact on the victims, which is why it’s important for us to talk about this topic.

You can be entitled to make a claim for data leak compensation, and you’re safe doing so with us.

The impact of hospital data breaches can be incredibly severe given that we’re talking about some of the most personal and sensitive information there can be.

This can mean that the victims of this kind of medical data breach can suffer more, and it can also mean that hospitals are a bigger target for hackers.

As expert data protection lawyers, we can tell you from years of real experience in fighting for the rights of data breach victims that these kinds of legal cases need a specific approach. When it comes to sensitive medical data that has been exposed, data breach compensation amounts can be higher, and it takes specialist lawyers like us to make sure you get the best representation possible.

As a ‘go-to’ name in the data breach compensation industry, we were asked by the I Paper to provide them with a list of Black Friday cybersecurity tips. We were more than happy to help.

As featured in the I Paper today, we have provided a list of safety tips for shoppers this Black Friday which also applies to the coming Cyber Monday. As great as deals can be for shoppers, in today’s age of cyberattacks and data exposure, consumers need to be careful.

You can read the tips in today’s print edition of the I Paper. We’ll also outline the basis of the information for you here as well under headings with some additional information.

If you or your dependent has been the victim of a college data breach, you can be entitled to bring a claim for compensation for any distress and / or financial loss that has been caused.

Most students at college will be under 18, and in these circumstances, a parent or guardian can bring the case for them as their formal ‘Litigation Friend’. We can offer the same No Win, No Fee representation we can offer for other cases, and damages can be awarded for any impact to the victim. If you’re an employee, we can help you as well.

Here’s some advice if this is an issue that has affected you or someone that you know.

Government data breaches can be incredibly serious, and when you look at why, it’s obvious. Victims of these kinds of data breaches should know their rights for justice as well, and this goes for both national and local government organisations.

I heard recently that a survey suggested that some IT bosses in the public sector consider that the data they hold is not as valuable as data in the private sector. Clearly, some of these individuals do not grasp the gravity of the extent of data that’s stored and processed by public sector organisations and would do well to consider this.

Given the nature of the data that they hold, and for how many people, any breach, leak or hack can be serious.

There has reportedly been yet another Three data breach, and the circumstances for the incident are almost the same as a previous one; which is worrying.

According to The Register earlier this month, there has been yet another case where people have been able to see the account information for other customers when using Three’s website. With the phone provider said to have around 10 million customers, any data breach they suffer could be monumental.

This isn’t the first time this exact problem has happened, and we have represented victims for Three data breaches in the past as well.

Any incidents involving medical data storage breaches can be serious, and they can easily happen as more and more of the healthcare sector is digitised and is accessible online.

It goes without saying that any and all data should be stored safely and securely, especially when it can be accessible online. Different organisations (be they Trusts, GPs, or insurers) that are involved in the healthcare sector may store data in different ways. Some may do it themselves, and some may use third-party hosting services. But whatever the services used, protection must be the priority.

If a medical data breach occurs as a result of a storage incident, victims should know that they can be entitled to make a claim for compensation.

EasyJet admits data of nine million hacked

British Airways data breach: How to claim up to £6,000 compensation

Are you owed £5,000 for the Virgin Media data breach?

Virgin Media faces £4.5 BILLION in compensation payouts

BA customers given final deadline to claim compensation for data breach

Shoppers slam Morrisons after loyalty points stolen

Half a million customers can sue BA over huge data breach

Lawyers accuse BA of 'swerving responsibility' for data breach

The biggest data breaches of 2020

Fill out our quick call back form below and we'll contact you when you're ready to talk to us.